Prof. ST Hsieh

Director, US-China Energy Industry Forum

626-376-7460

July 12, 2022

Opinion: Today’s energy crisis will probably become worse than the 1970s oil shock

Published: July 12, 2022 at 3:09 p.m. ET

By Daniel Yergin

Is today’s energy crisis as serious as similar previous ones — particularly the 1970s oil shocks?

That question is being asked around the world, with consumers hit by high prices, businesses worried about energy supplies, political leaders and central bankers struggling with inflation, and countries confronting balance-of-payments pressures.

So, yes, this energy crisis is as serious. In fact, today’s crisis is potentially worse.

In the 1970s, only oil was involved, whereas this crisis encompasses natural gas, coal, and even the nuclear-fuel cycle. In addition to stoking inflation, today’s crisis is transforming a previously global market into one that is fragmented and more vulnerable to disruption, crimping economic growth. And, together with the geopolitical crisis arising from the war in Ukraine, it is further deepening the world’s great-power rivalries.

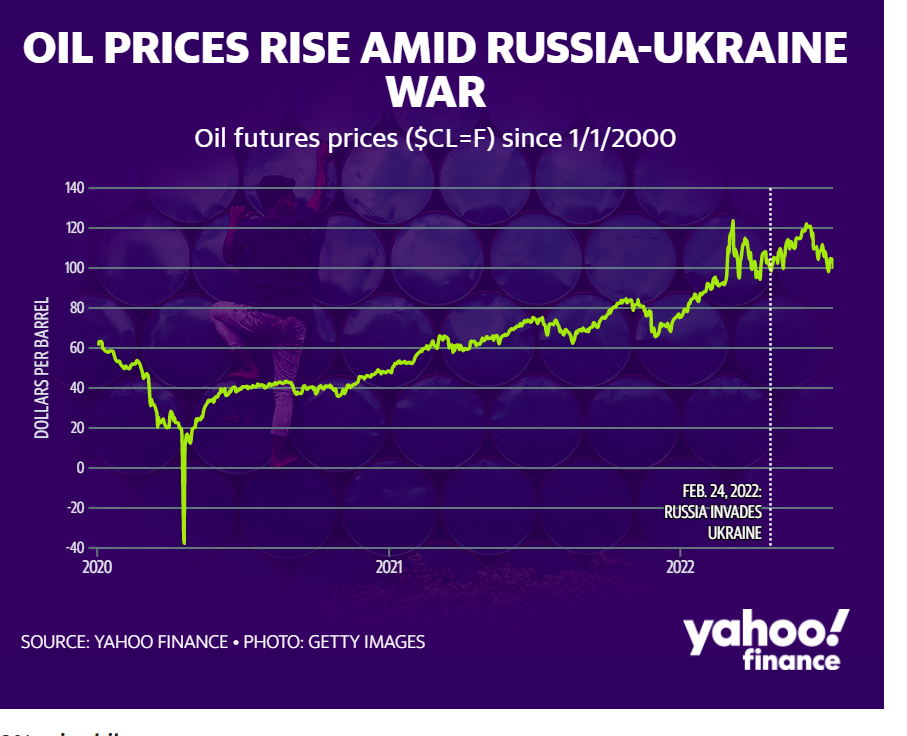

Today’s energy crisis did not begin with Russia’s invasion of Ukraine, but rather last year when energy demand surged as the world emerged from the COVID-19 pandemic. That is when China ran short of coal and prices shot up. The global market for liquefied natural gas (LNG) then tightened, with prices skyrocketing, and oil prices rose as well.

Normally, with rising energy prices, a country like Russia would have increased its natural-gas sales to its main customer, Europe, above the minimum contracted volumes. Instead, it stuck to its contracts, even though it could have produced considerably more. At the time, it appeared that Russia was trying to force prices up. But, instead, the Kremlin may well have been preparing for war.

Because Europe depended on Russia for 35%-40% of its oil and natural gas, Putin assumed that the Europeans would protest the invasion but ultimately stand aside. Fixated on his self-appointed mission of restoring what he views as Russia’s historic empire, he did not anticipate how they would respond to an unprovoked war next door.

Looking ahead, five factors could make today’s energy crisis even worse.

First, Putin has opened a second front in the conflict by cutting back on the contracted volumes of natural gas that Russia supplies to Europe. The goal is to prevent Europeans from storing enough supplies for next winter, and to drive prices higher, creating economic hardship and political discord. In his speech in June at the St. Petersburg International Economic Forum, Putin made his reasoning clear: “Social and economic problems worsening in Europe” will “split their societies” and “inevitably lead to populism … and a change of the elites in the short term.”

As it is, Germany is now anticipating the need for gas rationing, and its minister for economic affairs, Robert Habeck, warns of a “Lehman-style contagion” (referring to the 2008 financial crisis) if Europe cannot manage today’s energy-induced economic disruptions.

Second, a new or revived nuclear deal with Iran is unlikely. Thus, sanctions on the country will not be lifted — and that means Iranian oil will not be flowing into world markets anytime soon.

Third, although Saudi Arabia may step up its oil production to help “stabilize” oil markets in connection with U.S. President Joe Biden’s upcoming visit, no gusher is likely to follow, because there does not appear to be a large amount of extra oil in Saudi Arabia (or in the United Arab Emirates) that can be produced on short notice. Meanwhile, many other oil-exporting countries cannot even return to their previous levels of production, owing to a lack of investment and maintenance since the pandemic.

Fourth, China’s demand for oil has been significantly reduced by its “zero-COVID” lockdowns, which have sharply curtailed economic activity. But if it lifts many restrictions, a big increase in oil consumption and demand will follow.

Lastly, however tight the market for crude oil, there is even more tightness in the refining sector that produces the gasoline, diesel, and jet fuel that people actually use. This sector has developed into a complex, highly interconnected worldwide system. Russia was refining products that it was shipping to Europe, while Europe was sending gasoline that it did not need to the U.S. East Coast, and so forth.

In some places, the system is going all out, with U.S. refineries already operating at about 95% capacity. But the system overall still cannot keep up with demand.

Russian refineries are functioning only partly, depriving Europe of oil products; and not enough European gasoline is reaching North America. Chinese refineries are operating at less than 70% capacity. Some four million barrels per day of refining capacity have been shut down worldwide, owing to the pandemic, new regulations, and challenging economics. Add in the risk of accidents, poor policy decisions, and a hurricane knocking out refineries on the U.S. Gulf Coast, and the situation could get even worse.

That said, a few countries could still boost production. Canada — the world’s fourth-largest oil producer, after the U.S., Saudi Arabia, and Russia — could provide extra barrels in collaboration with its major market, the U.S. And U.S. shale oil production is back in gear and could add 800,000 to one million barrels per day of new production this year — far more additional production than the rest of the world combined.

Other factors that could mitigate the crisis include price changes and how consumers respond. In May, U.S. gasoline demand was 7% less than in May 2019, before the pandemic. Some of that, however, may be the result of more people working from home.

An economic slowdown could also dampen prices. S&P’s latest global purchasing managers’ index points to a weakening of economic growth, with U.S. manufacturing activity “slipping into a decline … to a degree only exceeded twice” — at the height of the pandemic lockdown and during the 2008 financial crisis. Likewise, European growth has slowed sharply to a 16-month low. Such slowdowns could reduce demand and lower energy prices. But, of course, they also will strain the Western alliance and popular unity.

The next six months will be critical, testing whether Europe can maneuver its way through the coming winter. In what Habeck called a “bitter” but “necessary” decision, Europe will need to burn more coal. In the difficult months ahead, there will need to be more informed collaboration between government and the industry that manages the energy flows on which modern economies depend.

Daniel Yergin, vice chairman of S&P Global, is the author of “The New Map: Energy, Climate, and the Clash of Nations” (Penguin, 2021).

Oil prices could spike ‘well over $150’ a barrel: Energy analyst says

·Reporter

Tue, July 12, 2022, 11:14 AM

The national average for a gallon of gas fell to $4.66 on Tuesday, dropping thirty-four cents since May 2022. However, some analysts believe that the recent relief in oil prices is only temporary.

“I think a lot of this, especially for oil, is going to go back to Russia. And I think you are going to see supply upended, if not at the end of the year, if not before. I think that has the potential to cause oil prices to even spike higher than what we just saw a couple months ago,” Neal Dingmann, Truist’s managing director of energy research, told Yahoo Finance Live.

50% price hike

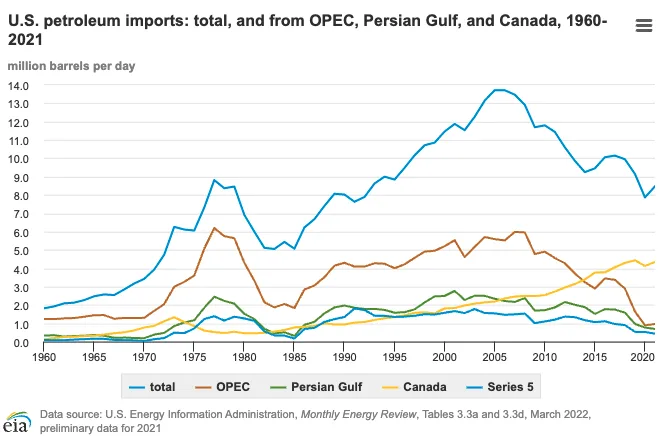

Dingmann predicted gas prices could rise “potentially 50%” if the U.S. doesn’t have an alternate source for Russian oil. In 2021, Russia and Saudi Arabia were the top petroleum importers for the U.S. The nations supplied 8% and 5% of the total market’s natural gas across the 50 states.

Dingmann explained that the OPEC nations don’t have the spare production cap acity to fulfill the supply deficit in the U.S. market at this point.

“Nearly all the OPEC+ members would be already producing more right now if they could. So, again, to me the only real true capacity, unfortunately out there, prior to all the issues, was in Russia.”

Dingmann pointed out that America “certainly” does not have the ability to expand domestic oil production. The supply shortfall resulted from the ban on Kremlin’s natural gas could bump crude prices “well over $150” per barrel, he added. (Currently, Brent is trading at around $100 per barrel (BZ=F) and the U.S. crude future (CL=F) is hovering about $97.)

U.S. Petroleum Import, 1960 – 2021

Biden visits Middle East

President Joe Biden is expected to negotiate his administration’s oil production agendas with Saudi Arabia on his trip to the Middle East this week. in an op-ed published this past Saturday in the Washington Post, Biden wrote that the oil exporter is “working with my experts to help stabilize oil markets with other OPEC producers.”

Biden’s tactic might turn out to be frivolous, said Dingmann. “Between the likes of Saudi, UAE, you name it, within OPEC+, they’ve all had the allowances to produce more and they basically say we’re going to stay constrained for various reasons,” because he believed, “they don’t have the capacity.”

Consumer’s demand for gas

On the flip side of the supply-shortage equation is America’s demand for gas. Essentially, the depth of consumers’ appetite will determine the height of the gas prices.

“I think in today’s environment I certainly think we could get close to $115 before you see any demand disruption,” Dingmann said.

Rebecca Chen is a writer and reporter at Yahoo Finance. Follow her on Twitter @RebeccaChenP