Prof. ST Hsieh

Director, US-China Energy Industry Forum

626-376-7460

May 2, 2022

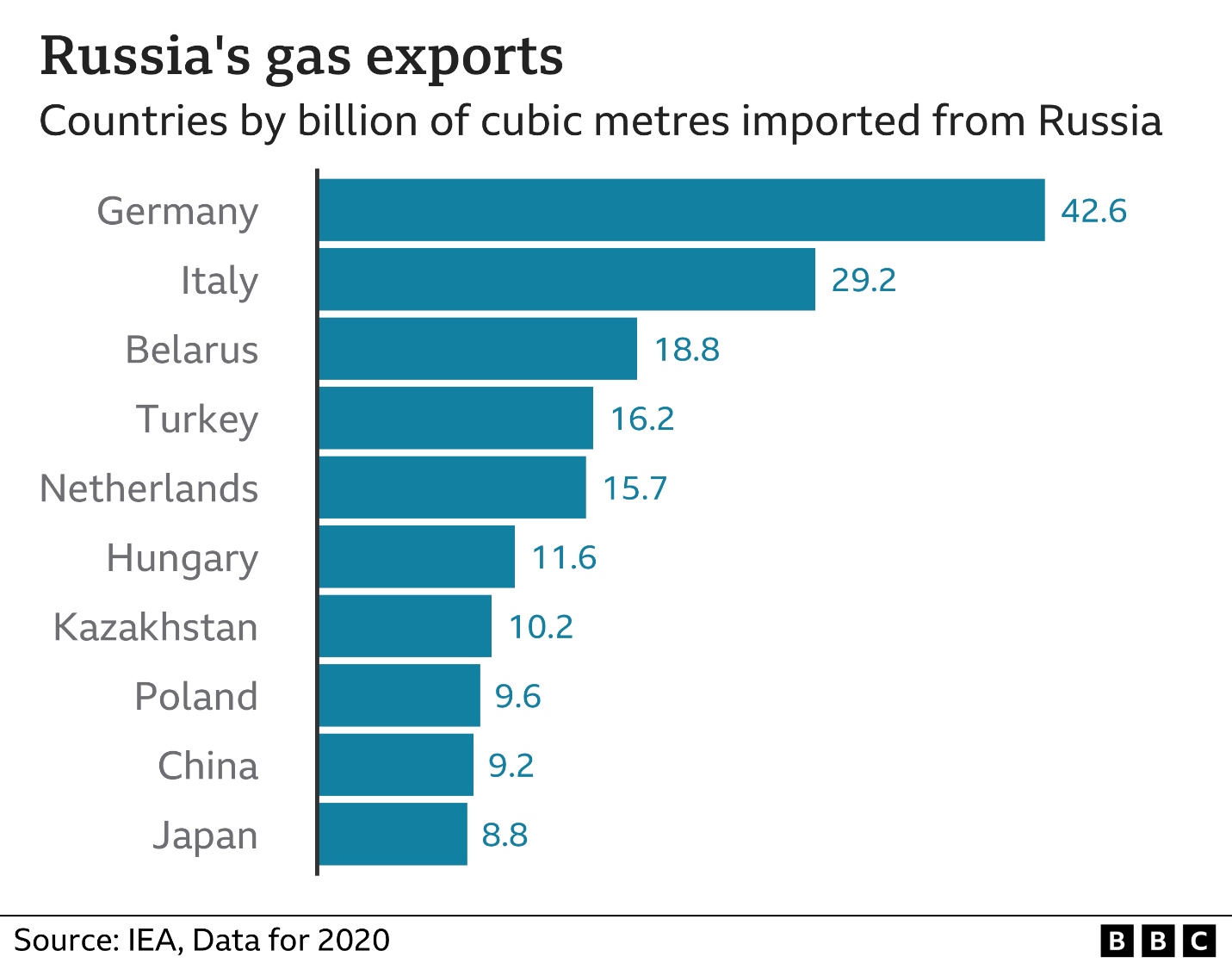

- Above and beyond headlines, the following graph was presented at BBC website. China’s reliance on Russian gas is miniscule as compared to major EU nations. The headline: “Russian natural gas exports to China jump 60 per cent in first 4 months” sounds alarming or exciting. But even six times increase of China’s import jump would be only comparable to the total of Germany and Italy.

- “especially those in Europe – to reduce their gas purchases from Russia.” Latest counts show that EU has been paying Russia for energy almost one-billion dollars per day now. Today, the Ukraine war entered the 68th day, so Putin has pocketed US$68 billion and counting!

- US and Qatar competing for the No. 1 LNG export nation is good news for consumers, provided that the global LNG market stays out of government interferences.

- Does sanctioning Russian energy make sense?

Russian natural gas exports to China jump 60 per cent in first 4 months

Mon, May 2, 2022, 2:30 AM SCMP

Russian gas producer Gazprom said natural gas exports to China went up 60 per cent in the first four months of the year from the same period of 2021.

It comes as Moscow’s invasion of Ukraine has prompted many major buyers – especially those in Europe – to reduce their gas purchases from Russia.

Gazprom on Sunday also said natural gas sales to non-Commonwealth of Independent States (CIS) countries had dropped to 50.1 billion cubic metres in the first four months – down 26.9 per cent from a year earlier.

The Russian gas exports were supplied to China via the Power of Siberia pipeline, which began operating in 2019. Some 4.1 billion cubic metres were delivered through the pipeline in 2020 and the aim is to supply 38 billion cubic metres – its full capacity – by 2025, according to the Gazprom statement.

Russian President Vladimir Putin in February signed an estimated US$117.5 billion of oil and gas deals with Chinese leader Xi Jinping. They included a contract for Gazprom to supply China with 10 billion cubic metres of gas a year via a new pipeline – the Power of Siberia 2 – that will run from the island of Sakhalin, in the Russian Far East, to Heilongjiang province in China’s northeast.

“Considering the contract signed in February, Russian gas shipments to China via the Far East routes could reach 48 billion cubic metres per year,” the state-owned gas producer said.

The new pipeline is expected to be up and running by 2026 and will mean that – together with the existing pipeline – the annual supply of natural gas could increase to 48 billion cubic metres from around 10 billion cubic metres in 2021.

Gazprom is also working on plans for another pipeline – the Soyuz Vostok – that will run from Russia to China via Mongolia and would mean an additional 50 billion cubic metres of gas could be piped to China every year.

While the West is imposing sanctions on Moscow over its aggression in Ukraine and Europe is seeking to end its reliance on Russian fuel, China – the world’s biggest energy consumer – has opposed sanctions and says its trade with Russia, including cooperation on oil and gas, will continue.

Russia exported 16.5 billion cubic metres of gas to China in 2021, including via the pipeline and in liquefied natural gas (LNG).

Before the war in Ukraine, Russia exported about 170 billion cubic metres of natural gas to the European market every year.

China’s total gas consumption was 372.5 billion cubic metres last year – 167.5 billion cubic metres of which was imported, according to official Chinese data. Gas imports increased by 19.9 per cent in 2021 from a year earlier.

U.S. LNG exports decrease, Europe remains top destination

Marcy de Luna Mon, May 2, 2022, 3:22 PM

HOUSTON, May 2 (Reuters) – U.S. exports of liquefied natural gas (LNG) fell about 8% last month, according to preliminary Refinitiv vessel tracking data on Monday, but Europe remained the top importer as the continent secures alternate supply following Russia’s invasion of Ukraine.

U.S. LNG exports to all destinations came to about 7.10 million tonnes (MT) last month, according to Refinitiv, down from a record high 7.67 MT in March.

Europe was the top importer of U.S. LNG for a fifth straight month, taking about 64% of U.S. exports, according to the data. European countries are slashing gas imports from Russia after its invasion of Ukraine. Moscow has threatened to cut supply to “unfriendly nations,” and even cut flow to Bulgaria and Poland last week.

“Europe remains the dominant buyer of U.S. volumes,” said Reid I’Anson, senior commodity analyst at Kpler. “That seems to be continuing into the shoulder months.”

The drop in U.S. exports stems mainly from planned maintenance at U.S. LNG plants, experts said, which reduces available liquefaction capacity, though exports still exceeded expectations.

Eventually, operators will have to conduct maintenance or risk operational troubles during peak winter demand.

“The longer and harder these facilities run, which they have been for the last year, the more likely you’re going to have issues pop up,” said Ross Wyeno, lead analyst of Americas LNG Analytics at S&P Global Commodity Insights.

Last month, U.S. energy company Sempra Energy’s Cameron LNG plant in Louisiana began a three-week maintenance period on a liquefaction train, while Freeport LNG had an 18-day maintenance period, according to S&P.

The United States is producing more LNG year-over-year because of additional capacity from Venture Global’s new Calcasieu Pass LNG export terminal in Cameron Parish, Louisiana, as it ramps up.

Cheniere Energy Inc’s Sabine Pass facility in Louisiana now has a sixth liquefaction train operating. The U.S. Energy Department last month approved Cheniere to export more LNG from its Sabine Pass and Corpus Christi, Texas, terminals.

About 13% of exports went to Asia and 2% to Latin America, data showed. About 21 vessels responsible for 21% of volumes had not signaled a destination.

Global prices have tapered off in recent weeks. The European LNG benchmark this week traded at $30 per million British thermal units (mmBtu), according to Refinitiv, compared with $39.22 per mmBtu for the same week in March.

Asia spot gas this week traded at $23.50 per mmBtu , down from $35.00 per mmBtu in March.

Qatar Reclaims Crown From U.S. as World’s Top LNG Exporter

Sergio Chapa

Mon, May 2, 2022, 9:14 AM

(Bloomberg) — Qatar reclaimed the crown as the world’s top liquefied natural gas exporter from the U.S. just as the end of winter lowered demand for the heating fuel in the northern hemisphere.

April exports of the superchilled fuel from Qatar surpassed 7.5 million metric tons, edging out the U.S., according to ship tracking data compiled by Bloomberg. Maintenance at Qatargas reduced the Middle Eastern nation’s exports a month earlier.

During the winter months, low temperatures, combined with Europe’s desire to cut dependence on Russian energy, drove up the demand for natural gas and prices of the fuel.

Once winter ended, some U.S. export terminals have used the period of softer demand and lower prices to undergo maintenance, which has lowered the U.S. production.

A shale gas revolution, coupled with billions of dollars of investments in liquefaction facilities, transformed the U.S. from a net LNG importer to a top exporter in less than a decade.

Looking ahead, the U.S. and Qatar are expected to engage in a two-horse race for dominance in the global LNG market. Once the Calcasieu Pass export terminal in Louisiana is complete later this year, the U.S. is expected to reach a peak LNG production capacity of 13.9 billion cubic feet of natural gas per day. Meanwhile, Qatar is planning a gargantuan export project that will come online in the late 2020s, which could cement the Middle Eastern nation as the top supplier of the fuel.