Prof. ST Hsieh

Director, US-China Energy Industry Forum

626-376-7460

July 23, 2022

Trump has been out of office for more than 18 months, but his foreign policy legacy is still hanging around our heads. Biden was elected President of the US because he promised that he is not Trump: he will not follow Trump’s policy and do better.

However, so far Biden has not accomplished much, and Trump is still a viable candidate for the US Presidency in 2024. While the general sentiment in the US is that Biden should not run for re-election in 2024. US-China relation is recognized as the most important bilateral relation now and for the foreseeable future. Biden promised us with a comprehensive new China strategy, but no specifics yet.

The US-China relation needs an urgent re-set, US is not doing a favor for China because the current status quo between the US and China is not stable or sustainable. The downside risk could be an ugly global disaster. There are many challenges between the US and China, there is no miracle solution for a cure for all. But an “adjustment” of Trump’s tariff war is overdue and could lead to potential breakthroughs on resolving other bilateral challenging issues.

US and China face different domestic and global challenges respectively including how to “close” the devastating COVID-19 global Pandemic. But if the global economy craters for any reason, including a nasty breakout of the war in Ukraine, both US and China can not escape the sufferings.

Resolving the US-China tariff war will not immediately revive the global economy, but it will eliminate some key uncertainties. A strong US economy and a strong China economy can serve as the cornerstone of a stable economy.

Of course, adjusting US tariff against China will have proponents and protests in the US, like any other public issue. In an open and democratic society, there is no policy issue is universally supported or universally opposed. As the President of the US, “the buck stops here.” Biden should make a decision as soon as possible and announce his China policy, especially his position on continuing Trump’s tariff war against China or not.

Biden’s indecision on US tariff war against China is hurting the US consumers in general as the attached data shows. Adjusting US tariff against China is really not about US inflation, but about the overall health of future US economy.

Specifically, the US-China relation re-set is not about short-term solution for US inflation. The global order/economy has suffered a double whammy after the outbreak of 2019 global COVID-19 pandemic and the war in Ukraine started on February 24, 2022. Should US and China take the leadership addressing global crisis?

Biden faces increasing calls for rolling back China tariffs amid inflation

Adriana Belmonte Sat, July 23, 2022, 12:59 PM

The latest inflation data for the U.S. was ugly.

According to the Consumer Price Index (CPI), inflation rose by 9.1% in the month of June, the most since 1981. Amid these record numbers, several industry experts are calling on the Biden administration to eliminate the country’s Section 301 tariffs on China.

“Between the COVID-19 pandemic and rising costs from inflation, the last thing that American businesses and consumers should have to worry about are tariffs,” Americans for Free Trade (AFT) Spokesperson Jonathan Gold told Yahoo Finance. “Enough is enough. It’s been over four years since the trade war began, and people across the country are only continuing to suffer. If the Biden administration is serious about promoting worker-centric policies, it will move swiftly to remove the harmful tariffs and help U.S. companies recover.”

The Section 301 tariffs were initially implemented by President Trump in 2018 in response to what he alleged was intellectual property theft. The tariffs affect roughly two-thirds of Chinese imports to the U.S.

These tariffs have come at a cost, however. According to new data from AFT, Americans have paid an estimated $129 billion in tariffs between July 2018 and April 2022. The last nine months have been the most expensive so far.

“Plain and simple, tariffs are a tax paid by the U.S. importer,” Gold said. “Those costs are unfortunately passed along to the consumer in the form of higher prices.”

‘We need to find more effective tools’ at dealing with China

While President Biden was highly critical of President Trump’s trade policies during his 2020 presidential campaign, Section 301 tariffs have remained in place. According to AFT data, taxpayers have actually paid more during the Biden administration.

For example, Alabama’s cost doubled from $21 million per month under Trump to $42 million under Biden; Georgia’s cost increased from $131 million to $257 million per month; and Washington’s jumped from $59 million to $115 per month.

“The best thing the administration can do at this point is to eliminate the harmful China 301 tariffs,” Gold said. “They have not been successful in addressing the ongoing forced technology and IP theft issues with China, which is why they were established in the first place. We need to find more effective tools to address the ongoing trade issues with China, including working with our allies who all share the same concerns.”

Barry reiterated that call, and said it would help even if it lowered inflation by just 1% or less.

“Remove the tariffs and you get rid of the clunky exclusion process and get a bigger bang on reducing inflation,” he said. “Our members oppose the tariffs because they aren’t working and Americans, not Chinese, are paying the bill.”

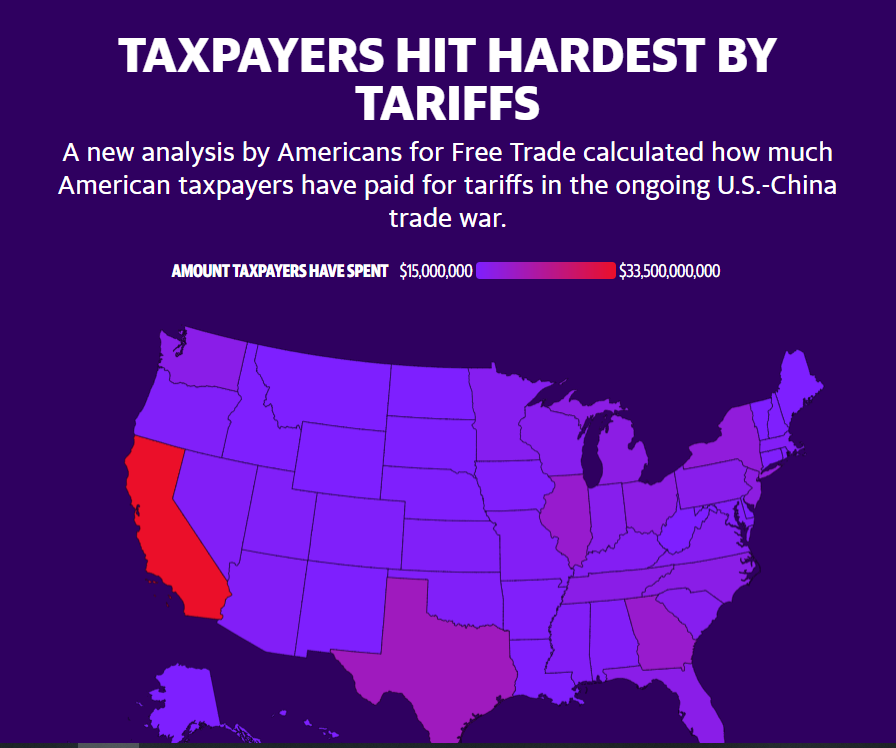

The AFT data also found that residents in some states have felt the effects of Section 301 tariffs harder than others.

California taxpayers have spent the most by far at $33.5 billion, the AFT data found. Texas ($10.2 billion), Georgia ($7.9 billion), and Illinois ($7.7 billion) residents have also been particularly affected.

Much of this has to do with how many jobs in each of the states are supported by trade. More than 5 million jobs in California are tied to trade, for example.

Initially, President Trump granted exemptions to Section 301 tariffs, which helped to alleviate the burden for many taxpayers. These exemptions expired at the end of 2020 and have not been extended since.

The states where taxpayers paid the most are additionally the states that benefited the most from those exemptions. For example, California was able to save $5.7 billion while Texas saved $1.6 billion.

Companies were also able to benefit from these exemptions. According to AFT, they were able to avoid $21 billion in payments to the government until the exclusions ended on December 31, 2020.

“The average 301 tariff rates themselves are higher now since nearly all of the previously granted exclusions expired at the end of 2020,” Gold said. “Recent record 301 costs are the result of this combination of higher import volumes due to demand and higher rates due to expired exclusions.”

Doug Barry, vice president of the U.S.-China Business Council, stated there are other “insidious effects” policymakers didn’t consider when implementing these tariffs.

“One of our members, a six person engineering firm, that imports intermediate products from China that have a tariff rate of 25%, pays a half million dollars per year to the U.S. Treasury,” Barry told Yahoo Finance. “With this money, he could hire a couple of engineers to grow his business and create more jobs.”

A new report from the Consumer Technology Association (CTA) found that the tech sector has especially been affected by Section 301 tariffs. According to the CTA findings, “tech manufacturing jobs stagnated, and, in some cases, declined after the tariffs were imposed.”

Between July 2018 to December 2021, tech companies have paid an estimated $32 billion in tariffs for their products, the report stated.

‘None of this matters very much to inflation’

According to Gold, as consumer demand ramps back up, it will put the U.S. in a tough spot without being able to import from China sans tariffs.

“That demand cannot be met by U.S. manufacturing or non-Chinese sources alone,” he said.

Matthew Shay, president and CEO of the National Retail Federation, argued that removing the tariffs can help address inflation.

However, not everyone agrees with that idea. According to Derek Scissors, chief economist of the China Beige Book and member of the U.S.-China Economic and Security Review Commission, “none of this matters very much to inflation.”

Current inflation is highway sign inflation,” Scissors said on Yahoo Finance Live recently. “It’s gas, food, lodging. We don’t import any of that from China. So what’s causing prices to go up, what’s causing consumers to feel pinched is not going to be affected by removing China tariffs. The tariffs were imposed in 2018 and 2019. Obviously, they didn’t cause inflation then.”

Scissors argued that in the grand scheme of things, tariffs are only a small part of U.S. consumption.

“If you want to have an effect on inflation … a stronger dollar reduces the cost of all imports,” he said. “And that would be a more powerful tool than reducing the Trump tariffs.”