Prof. ST Hsieh

Director, US-China Energy Industry Forum

626-376-7460

March 30, 2023

US EIA report states that the US crude oil exports increased to a new record in 2022 and it will keep the upward momentum in 2023. US oil export to Europe picked up after the Ukraine war broke out and the ensued sanctions against Russia implemented by the west.

Russia re-routed her energy export to Asia, India and China became major importers of cheap Russian oil. On the other hand, US oil export found a new market in Europe with premium price.

The sanctions were meant to cutoff Russian economy to the extent that Putin will have to leave Ukraine. But the data showed that sanctions so far have not been completely successful. War has been raging on the ground of Ukraine for more than 400 days, but there is no sign that Ukraine is wining, despite unprecedented financial and military support from the west. There are signs that western support for Ukraine is cracking. Russia, despite the reported suffrage and loss, is still fighting in Ukraine. Even China’s peace proposal, the only attempt, has not been totally rejected by Ukraine.

However, the global economy faces many challenges even though the threat of COVID-19 pandemic is easing. The Russian-Ukraine hot war and a new cold war between the US and China, plus natural disasters, may cause global recessions anytime. The rosy predictions of expanding energy demand may end sooner than later.

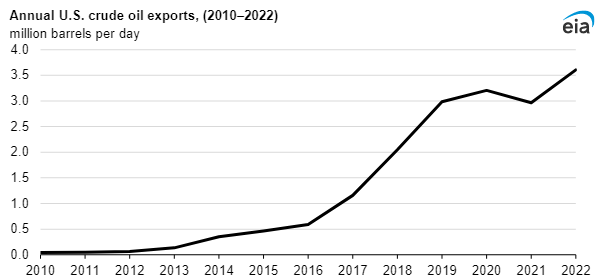

In 2022, U.S. crude oil exports increased to a new record, 3.6 million barrels a day

Data source: U.S. Energy Information Administration, Petroleum Supply Annual and Petroleum Supply Monthly

In 2022, U.S. crude oil exports averaged 3.6 million barrels per day (b/d), a record high according to export data that has been collected since 1920. U.S. crude oil exports in 2022 were 22% (640,000 b/d) higher than in 2021. Increased U.S. crude oil production, releases from the U.S. Strategic Petroleum Reserve, and more global demand for crude oil from countries other than Russia all drove the growth in U.S. crude oil exports.

Since early 2022, trade patterns have shifted because of Russia’s full-scale invasion of Ukraine and the ensuing Western sanctions of Russia’s crude oil exports. Prior to 2022, OECD Europe had been the largest regional importer of Russia’s crude oil, receiving 2.3 million b/d from Russia in 2021.

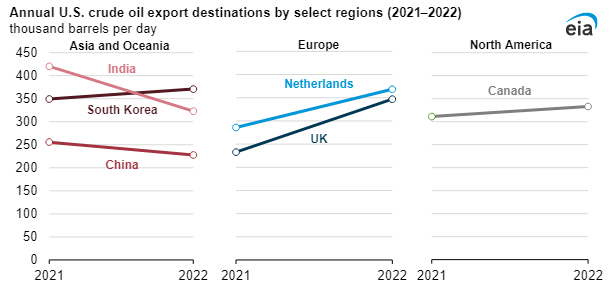

Less crude oil was exported to India and China from the United States in 2022 than in 2021 because the two countries imported more discounted crude oil from Russia. India was the largest export destination of U.S. crude oil exports in 2021; China had been in 2020. Decreased demand for U.S. crude oil exports to India and China was more than offset by increased demand from other destinations, particularly in Europe.

Data source: U.S. Energy Information Administration, Petroleum Supply Monthly

Data source: U.S. Energy Information Administration, Petroleum Supply Monthly

Despite declines in exports to India and China, Asia and Oceania remained the regional destination receiving the most U.S. crude oil exports in 2022, 43% (1.55 million b/d). Europe ranked a close second, at 42% (1.51 million b/d). Asia and Oceania is the region that has received the greatest volume of U.S. crude oil since 2017, with Europe receiving the second-most since 2018.

EU sanctions implemented in December 2022 that prohibit all seaborne imports of Russia’s oil to Europe make it likely that demand for U.S. crude oil will continue in 2023.

Principal contributor: Alexander de Keyserling

Factbox-EU keeps on doing business with Russia despite sanctions

Gabriela Baczynska

Wed, March 29, 2023 at 1:46 AM PDT

BRUSSELS (Reuters) – With ten rounds of sanctions since Russia invaded Ukraine in February last year, the European Union has rolled out its toughest punishment ever against a foreign country.

The EU says its sanctions are meant to cut Moscow revenues and access to technology used in war. But the impact “will not be severe enough to limit Russia’s ability to wage war against Ukraine in 2023,” a European Parliament research note said.

Much trade still flows between the bloc’s 27 countries and Russia – a result of successful lobbying, the EU’s unwillingness to take a harder economic hit, and concerns about ripple efffects on global supply chains.

Rather than seek new sanctions, the EU now wants to crack down on bypassing those already imposed and officials identified the UAE, Turkey, Armenia, Georgia, Kazakhstan and Kyryzstan as potential circumvention routes.

Here is a list of areas where the EU keeps on doing business with Russia.

TRADE FLOWS

In 2021, Russia was the EU’s fifth-largest trading partner with goods exchange worth 258 billion euros, according to the EU executive European Commission. The main EU imports were fuel, wood, iron and steel and fertilizers.

Since the invasion in 2022, the value of EU imports from Russia fell by a half to around 10 billion euros last December.

In total, the EU imported 171 billion euros worth of goods from Russia starting from March, 2022 until the end of January, 2023, according the latest data available from Eurostat, the EU statistics office.

That figure thwarts the 60 billion the EU last month said it had assigned to Ukraine over the year since the invasion, though that total does not include the value of modern tanks Kyiv got since, or the latest deal on ammunition supplies.

LNG

The EU sanctioned imports of Russian coal and seaborne oil last year. Gas is not covered by EU sanctions, but Moscow slashed pipeline deliveries to Europe since the invasion. In 2022, the EU received about 40% less Russian gas than in recent years.

Liquefied natural gas is another story. Russian LNG deliveries to Europe increased since the war – to 22 billion cubic metres in 2022, up from around 16 bcm in 2021, according to EU analysis.

NUCLEAR

Similarly, there have been no sanctions against Russia’s nuclear industry, something Hungary – where Russian state nuclear energy company Rosatom is due to expand the Paks power plant – and Bulgaria openly oppose.

EU imports of Russian nuclear industry products totalled nearly 750 million euros in 2022, according to Eurostat. EU nuclear agency Euratom said Russia provided a fifth of uranium used by EU utilities in 2021, the latest data available, as well as a fourth of conversion and a third of enrichement services.

The French energy ministry disputed parts of a report by Greenpeace, which last month said Paris had sharply increased imports of enriched uranium from Russia since the invasion. Paris said its contracts with Russia would be more expensive to halt than continue.

DIAMONDS

The EU bought 1.4 billion euros worth of Russian diamonds last year, according to Eurostat, as it banned neither the gem imports nor blacklisted Russian state-controlled miner Alrosa.

Belgium, home to the world’s biggest diamond trading hub Antwerp, has upset the bloc’s hawks by lobbying against the EU going solo on Russian diamonds.

CHEMICALS AND RAW MATERIALS

EU imports of Russian fertilizers were worth 2.6 billion euros last year, more than 40% up from 2021 as price rise beat reduced volumes, according to Eurostat.

Potash from Russia and ally Belarus is heavily restricted or banned in the EU. But other fertilisers including urea flow freely, said Sean Mackle of industry lobby Fertilizers Europe, adding that the patchy approach weighed on implementation.

Among raw materials unaffected by sanctions is nickel, mostly used for stainless steel production. The EU imported 2.1 billion euros worth of nickel in 2021, up to 3.2 billion euros last year, according to Eurostat.

BIG NAMES AND SECONDARY SANCTIONS

Alrosa and Rosatom are missing from the EU’s blacklist that currently covers nearly 1,700 individuals and entities banned from the bloc. Gazprombank – the financial arm of Russia’s gas monopoly Gazprom – and Russia’s privately-owned, second-largest oil producer Lukoil are also missing.