Prof. ST Hsieh

Director, US-China Energy Industry Forum

626-376-7460

April 4, 2023

The US Energy Information Agency (EIA) independently collects energy data and carries out analysis with projections. The following projections with different scenarios are valuable.

The most notable statement is the US production “to be driven by international demand.” The US is already a net energy exporter including petroleum. US domestic demand of petroleum is safe and secure, however international demand will be largely determined by the global economic conditions. As the US and China are competing for global supremacy, the global economy risks to be decoupled and break into two or three major trading groups. If the US-China competition gets out of hands that will be the “low oil price, low oil and gas supply” scenario.

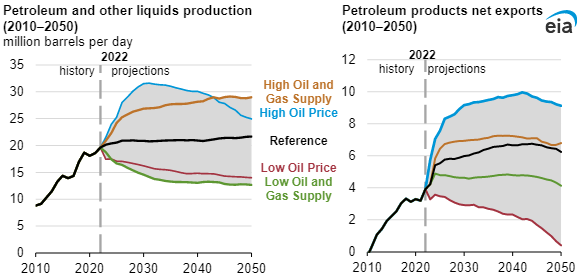

U.S. production of petroleum and other liquids to be driven by international demand

Data source: U.S. Energy Information Administration, Annual Energy Outlook 2023 (AEO2023)

Note: We do not include biofuels in petroleum and other liquids production. Shaded regions represent maximum and minimum values for each projection year across the AEO2023 Reference case and side cases.

Strong continuing international demand for petroleum and other liquids will sustain U.S. production above 2022 levels through 2050, according to most of the cases we examined in our Annual Energy Outlook 2023 (AEO2023). We project that the United States will continue to be an integral part of global oil markets and a significant source of supply in these cases, as increased exports of finished products support U.S. production.

In our AEO2023, we explore long-term energy trends in the United States and present an outlook for energy markets through 2050. We use different scenarios, or cases, to understand how varying assumptions about the future could affect energy trends. These cases include:

- The Reference case, which serves as a baseline, or benchmark, case. It reflects laws and regulations adopted through mid-November 2022 but assumes no new laws or regulations in the future. It also assumes the Brent crude oil price reaches $101 per barrel (b) (in 2022 dollars) by 2050.

- The High Oil and Gas Supply case, which assumes 50% more ultimate recovery per well for tight oil, tight gas, or shale gas in the United States compared with the Reference case. It also assumes 50% more undiscovered U.S. oil and natural gas resources and 50% more effective technological improvements than in the Reference case.

- The Low Oil and Gas Supply case, which assumes 50% less ultimate recovery per well and undiscovered sources, and 50% more effective technological advancement than the Reference case.

- The High Oil Price case, which assumes the price of Brent crude oil reaches $190/b (in 2022 dollars) by 2050.

- The Low Oil Price case, which assumes the price of Brent crude oil reaches $51/b (in 2022 dollars) by 2050.

In the Reference case, we project modest growth in U.S. production of petroleum and other liquids through 2050, increasing about 10% from 2022. The other cases show a wider range of outcomes, ranging from a 48% increase in U.S. production between 2022 and 2050 in the High Oil and Gas Supply case to a 35% decrease in production in the Low Oil and Gas Supply case.

In the High Oil Price case, U.S. crude oil production initially increases rapidly due to high prices. However, crude oil production begins to fall after 2030 because wells are drilled increasingly close to one another, resulting in less well productivity. Eventually this trend becomes unprofitable, at which point new drilling stops. Because of the lack of new drilling, petroleum and other liquids production decreases between 2030 and 2050. By 2050, we project in the High Oil Price case that production increases by 27% compared with 2022, much less than the increase projected in the High Oil and Gas Supply case over the same time period.

Although domestic consumption of petroleum and other liquids does not increase through 2040 across most cases, production of U.S. petroleum and other liquids remains high because of more exports of finished products. In the High Oil Price case, increased production leads to the most U.S. exports among all cases over the projection period at 9.13 million barrels per day (b/d) by 2050, more than double the 3.9 million b/d exported in 2022. The Low Oil Price case shows the opposite trend with the least 2050 export volumes of 407,000 b/d, nearly 90% less than 2022 exports.

Principal contributor: Estella Shi