Prof. ST Hsieh

Director, US-China Energy Industry Forum

626-376-7460

January 27, 2024

Taiwan is a hot issue for global security as the US and China are making it a “treasure island.” Some experts around the world are targeting the Taiwan strait as the most dangerous region in the world, implying that China may be provoked by the US to attack Taiwan anytime.

However, if one takes a close look at Taiwan, she is already facing critical challenges caused by her natural resources but aggravated by domestic politics. Specifically, electric energy supply is a major risk. The government sets up an unrealistic goal for green energy transition but at the same time stubbornly rejects greenhouse gas free nuclear power. The ruling party accelerated the decommissioning of the existing nuclear power plants. Their energy policy was established under two major misconceptions:

- All green energy costs more but, bowing to political pressures, the administration has to subsidize the state owned Taipower so that the consumers can afford the electricity without rebelling. But it is not sustainable.

- Aside from cost, industry demands a stable baseload power supply around the clock. This is particularly true for high-tech manufacturers such as TSMC. Nuclear power is the only “green” power source that can support large baseload around the clock with a reasonable cost.

Taiwan is a landlocked island with very limited resources. In order to provide sufficient electric power for the industry, Taiwan administrations have had to rely on imported LNG. It is a high-cost commodity with a short storge life cycle: LNG reserve usually lasts only about two weeks. In case of a crisis scenario, either a supply-transport shock or a military blockade, there is no escape for Taiwan.

In fact, high-tech industry such as TSMC, also needs constant supply of large amount of clean water. Taiwan, like many parts of the world, say Arizona USA, are affected by the global climate changes. Fresh water is also a natural resource that cannot depend on imports.

Taiwan’s Troubled Utility Poses Risk to Chipmakers’ Green Goals

Sing Yee Ong, CNN

Fri, January 26, 2024 at 4:00 PM

Taiwan’s Troubled Utility Poses Risk to Chipmakers’ Green Goals

(Bloomberg) — The precarious finances of Taiwan’s sole electricity utility are threatening the island’s clean energy ambitions, tarnishing its attractiveness as a manufacturing hub for the world’s biggest chipmakers and even adding to its vulnerability in the event of a conflict with China.

Taiwan Power Co. is forecasting another massive loss in 2023 and doesn’t see much of an improvement this year. The state-owned company, known as Taipower, has been unable to fully pass on higher costs for gas and coal to customers due to political pressure to keep power prices low. It’s also made a bet on offshore wind, a renewable technology that’s facing difficulties across the world as costs and delays increase.

If Taipower can’t make sufficient progress on clean-energy generation, the island could potentially lose some of its allure as a destination for chip manufacturing. Taiwan Semiconductor Manufacturing Co., the world’s largest chipmaker that supplies the likes of Apple Inc. and Nvidia Inc., has a target of using 100% renewables by 2040.

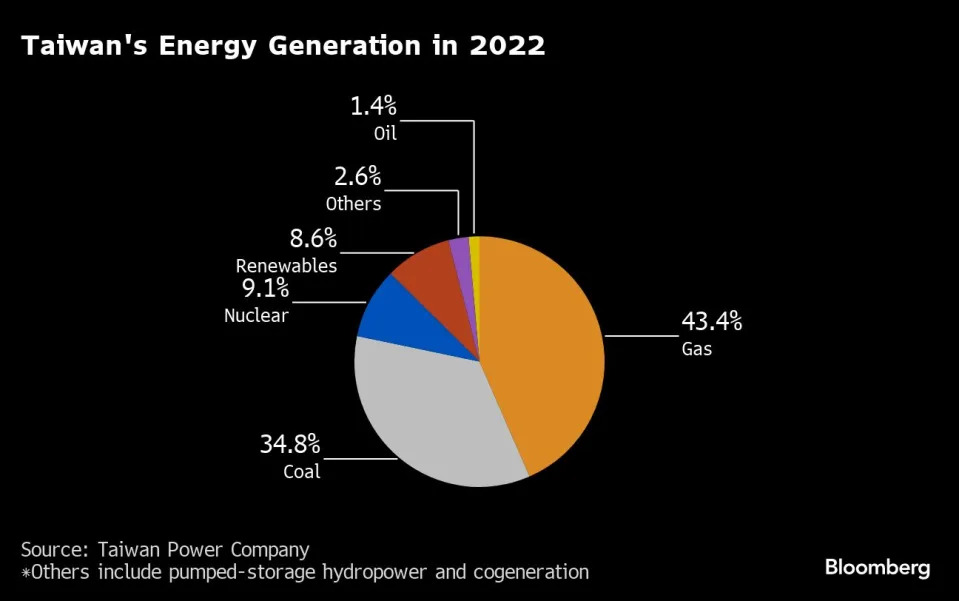

Taiwan’s heavy reliance on imported fossil fuels, around 80% of its electricity came from gas, coal and oil in 2022, also leaves it vulnerable in the event of an attack or even a naval blockade by China. The government wants green power to make up 20% of the mix by 2025, from around 8% in 2022 — a challenging target given that it’s also aiming to phase out nuclear generation.

“Renewable energy is in need more than ever to fill the absence of nuclear power,” said Uran-Ulzii Batbayar, an analyst at research firm Rystad Energy. Adding more green generation requires substantial capital, and Taipower’s financial situation raises concerns about potential power disruptions affecting major chip manufacturers, she said.

Taipower is forecasting a loss of NT$198.5 billion ($6.3 billion) for 2023, following an even worse result in the previous year. The utility sees another loss, of NT$188.7 billion, this year.

The company is conducting an internal financial review and will report the results to the Ministry of Economic Affairs, it said in a statement last week, in which it also said it has no current plans to raise electricity prices this year.

“Taipower plays the role of a shock absorber on the frontlines, absorbing the impact brought by imported inflation,” it said in an emailed response to Bloomberg questions, adding that it has been exploring new sources of income and reducing costs to improve its financial position.

The utility did raise prices by an average of 11% last year and 8.4% in 2022, though the adjustments mainly affected industrial consumers, according to a report in the Taipei Times.

‘Political Pressure’

But the increases paled in comparison to the jump in its fuel costs over the period, which were partly driven by a global energy crunch that followed Russia’s invasion of Ukraine. Asian benchmark prices for power-station coal surged almost 160% in 2022, and while they gave up much of those gains last year they’re still well above where they were in 2019 and 2020. It’s a similar story for natural gas.

“Taipower is a state monopoly utility, so it’s under political pressure to ensure low electricity prices, regardless which party is in power,” said Robert Liew, Wood Mackenzie’s director of APAC power and renewables research.

For now, the island’s government is still hoping much of the increase in renewables will come from offshore wind, even if many of these projects are in trouble due to rising costs and worsening delays. Requirements that developers buy equipment from Taiwanese equipment manufacturers have added to the industrywide troubles.