Prof. ST Hsieh

Director, US-China Energy Industry Forum

626-376-7460

September 2, 2023

Right around February 22, 2022, when the proxy war in Ukraine was just fired up, the world was told that it was all Russia’s fault. The politicians in Europe told the world that Europe had been overly dependent on Russia natural gas, so the Ukraine war was a case of cutting off Russian energy supply to Europe. Then the US led allies implemented unprecedented sanction measures against Russia, especially focused on instantly energy independence for Europe, and at the same time kill the Russian economy. The sanctions applied are not just limited to Russian energy exporters but also global importers and merchants moving the commodity.

The following news reports seem to make the pretense of the proxy war in Ukraine obvious. After more than 18 months of bloody war that has caused hundreds of thousands of human lives, Europe is still importing about 10% of the gas needs from Russia as of today. When this winter season lands in Europe soon, more gas will be imported from Russia. In the meantime, there is no sign that Ukraine is repelling Russians. How long this energy war should last? Obviously, those politicians who started the proxy war have no clue, but their people are paying the price everday.

The Russian fossil fuel Europe can’t get enough of

Tim McDonnell

Fri, September 1, 2023 at 8:22 AM PDT

The News

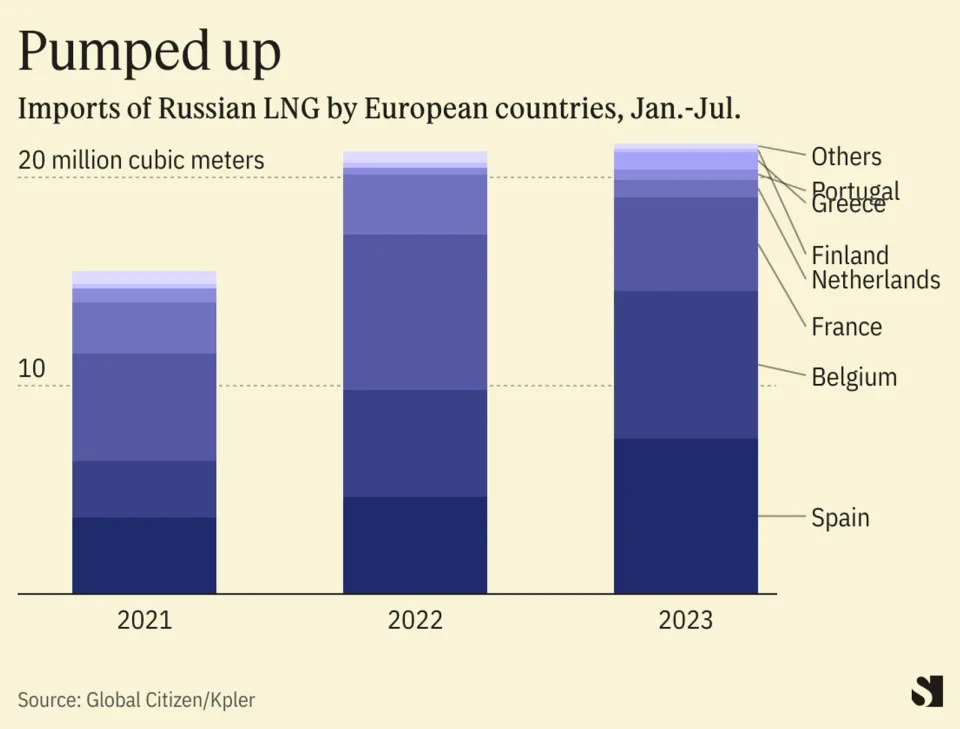

European countries are buying more liquified natural gas from Russia than they did before its full-scale invasion of Ukraine last year, revealing a weak spot in the energy sanctions targeting Russia that is unlikely to be resolved anytime soon.

In the first six months of 2023, EU countries bought 40% more Russian LNG than they did in 2021, amounting to $5.7 billion in revenue for Russia, according to an analysis this week by the advocacy group Global Witness. This makes Europe the biggest customer for Russian LNG; only the U.S. sells more LNG to the bloc.

Tim’s view

After the invasion, European countries quickly cut their dependence on natural gas delivered via pipeline from Russia, which until then had supplied about half of the continent’s principal fuel for electricity production and industrial facilities. But they’ve effectively swapped one fossil fuel import dependency for another that will be harder to kick.

Many European countries are accelerating plans to expand their LNG import infrastructure, while also speeding construction of renewables. Last winter, Russian gas cuts caused record-breaking energy price spikes that the continent is still recovering from: In Germany, the bloc’s top industrial economy, manufacturing activity has contracted for 14 consecutive months largely because of energy costs. This week Germany’s chancellor rejected a call from industry groups for greater energy subsidies, arguing that the government’s plan to boost LNG imports, especially from the U.S., is a better long-term solution.

But a greater reliance on LNG inevitably leads back to Russia, which is seeking to triple exports from its Yamal LNG facility in Siberia. That’s a problem for the bloc’s stated goal to completely eliminate its consumption of Russian fossil fuels by 2027. And it has made LNG a focal point for Ukrainian activists, who are calling for a ban on imports from Russia (and also bemoaning the EU’s weak enforcement of existing sanctions on refined oil products).

“These figures are really horrifying,” said Svitlana Romanko, director of clean energy advocacy group Razom We Stand. “These countries are spending a lot of resources to help Ukraine, so I can’t explain why they’ve become so addicted to Russian LNG.”

That viewed is shared by Spanish Energy Minister Teresa Ribera, who has called the volume of Russian LNG imports “absurd” even as her country has become the top importer, and EU Energy Commissioner Kadri Simson, who has backed a plan, currently stalled in negotiations, to block EU companies from signing new deals with Novotek, Russia’s LNG export company.

“I’m sure they want to cut LNG imports from Russia entirely,” said Ben Cahill, a senior energy fellow at the Center for Strategic and International Studies, “but for now they don’t have the luxury of doing so.”

Room for Disagreement

One compelling argument against an LNG ban is that it could hurt the EU more than the Kremlin. Since the full-scale invasion, LNG has provided only about 8% of Russia’s fossil fuel export revenue, according to data from the Centre for Research on Energy Clean Air, a Finland-based think tank. Banning it would likely spark a bidding war between European and Asian countries for LNG shipments from the U.S., which would need to fill much of the gap.

“A lot of European politicians were upset about perceived profiteering by U.S. oil and gas companies during the energy crisis,” said Paddy Ryan, assistant director for European energy security at the Atlantic Council. “So getting rid of a competitor to the U.S. is something they’d be loath to do.”

The View From Beijing

Notwithstanding Europe’s rising LNG purchases, Russia’s overall fossil fuel revenue is down significantly since the full-scale invasion, which has provided an opening for China to snap up Russian products at a discount. China is now the top buyer of Russian coal and crude oil, and the number-two buyer of LNG.

Notable

- EU leaders are especially keen to avoid energy price spikes as they near a Dec. 31 deadline to phase out existing emergency energy subsidies implemented after the invasion. While European Commission leaders are keen to enforce that deadline, the French and German governments are pushing to extend them, Politico reported, setting up a showdown with big implications for Europe’s industrial economy.

Russian LNG Flows to Europe Slump on Weaker Demand, Maintenance

Elena Mazneva

Fri, September 1, 2023 at 2:11 AM PDT

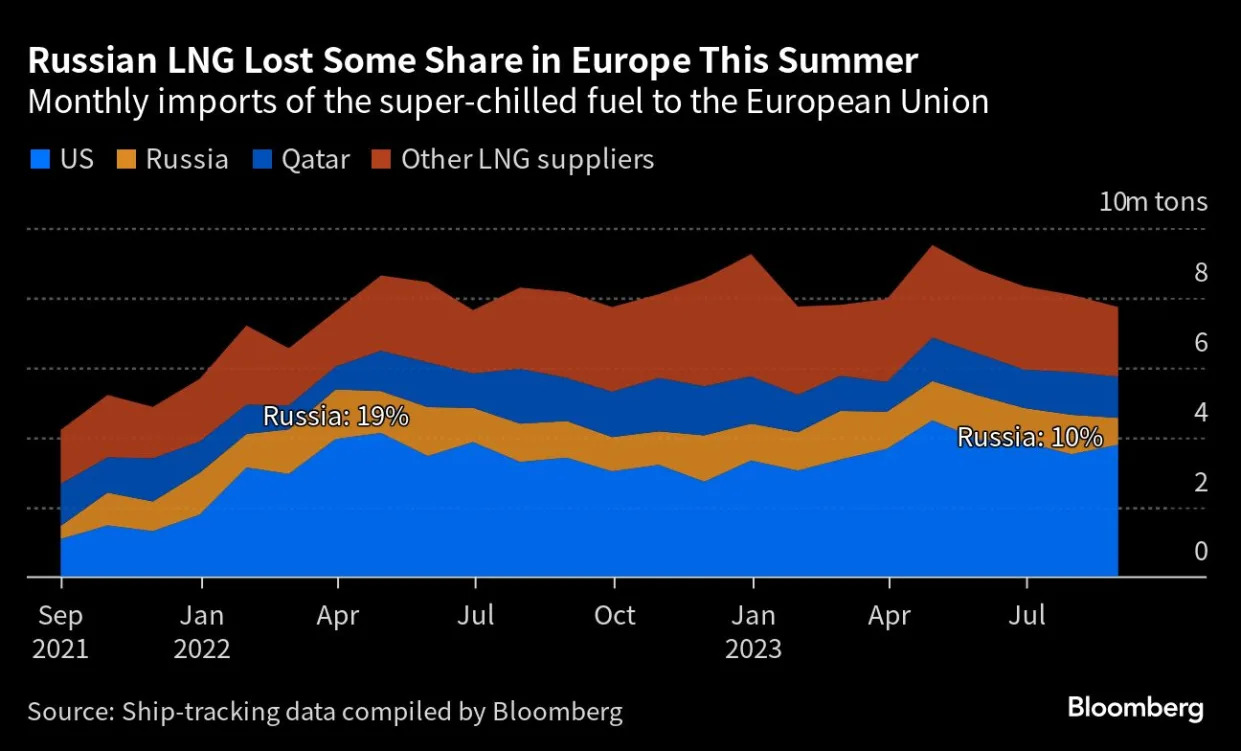

(Bloomberg) — Russian liquefied natural gas shipments to the European Union slumped last month due to plant maintenance and weaker demand, but exports could rebound if a cold snap this winter boosts consumption.

Russian LNG arrivals in EU ports fell more than 25% in August from a year earlier to about 770,000 tons, the lowest level for any month since 2021, according to preliminary ship-tracking data compiled by Bloomberg. While the region’s overall imports also declined, Russia’s export capacity was also curbed by annual works.

The country’s share of EU LNG imports dropped to about 10% in August — down from 19% in March last year, during the panic buying triggered by Moscow’s invasion of Ukraine. The US, Europe’s No. 1 LNG supplier, increased its share to 49% last month, while Qatar maintained its 15%.

The EU is “making efforts to divest away from Russian gas as quickly as possible,” while also keeping in mind its energy security, European Commission spokesman Tim McPhie told reporters in Brussels on Thursday. He said overall reliance on Moscow — even after the jump in Russian LNG flows last year — is far less than it used to be.

Russian gas, both piped and liquefied, now covers less than 10% of Europe’s total demand compared with more than a third before the invasion.

LNG flows from Russia have been mostly down year-on-year since March, but remain far above 2021 levels, according to ship-tracking data. That slide came as the Netherlands curbed purchases and Germany shunned them altogether, relying on the US and other suppliers. There was also some increase in demand for the Russian fuel in Asia.

Still, the situation may change this winter, especially if cold weather boosts demand. Should that happen, Russia will be prepared, with export capacities set to rebound this month after annual maintenance.