Prof. ST Hsieh

Director, US-China Energy Industry Forum

626-376-7460

March 9, 2023

The Ukraine war is grinding on after the fighting started more than one year ago, Ukraine as a nation is suffering badly. After the war is eventually over, recovery will take generations.

Ukraine war has many other causalities, Euro Zone under the leadership of the US, actively supported Ukraine with significant amount of financial and military aids. Euro Zone also severely sanctions Russia with the intention of weakening Putin and end the war. But these sanctions cut both ways, as expected, Euro Zone’s economy grounded to the stop at end of 2022.

Ukraine war has no end in sight, a global recession is not of the question. There is no winner, but unfortunately there is still no serious effort to end the war.

Euro Zone’s Economy Failed to Grow at End of Last Year

Alexander Weber

Wed, March 8, 2023 at 2:00 AM PST

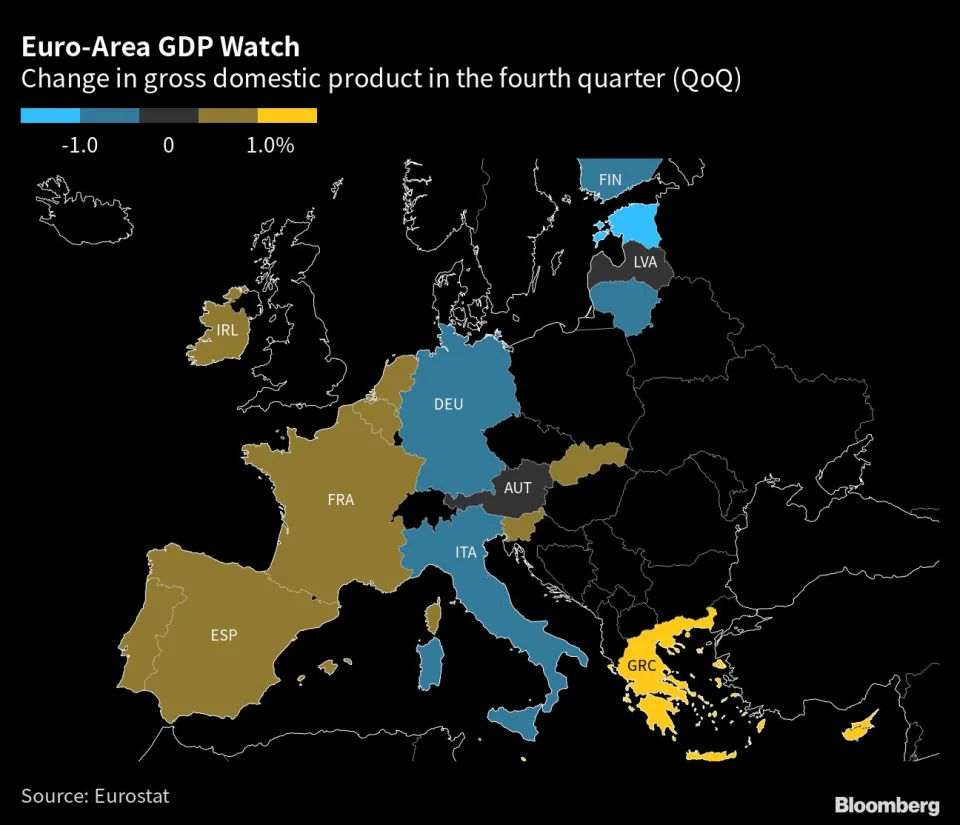

(Bloomberg) — The euro-area economy failed to expand at the end of 2022 as worse-than-expected performances in Germany and Ireland helped pull down initial growth readings.

Gross domestic product was unchanged from the previous quarter during the final three months of last year — worse than the preliminary estimate for a 0.1% advance — data released Wednesday by Eurostat showed.

While household expenditure and investment declined, government spending and trade helped offset the drops. Germany’s economy, the continent’s largest, shrank by 0.4%, while Ireland’s rose by significantly less than initially reported.

While gloomier than thought, stagnation means the bloc may still manage to narrowly dodge a recession that was seen as unavoidable after Russia invaded Ukraine. Looking ahead, analysts predict a downturn in the first quarter as the rising cost of living continues to weigh on consumers.

Inflation remains a problem. A measure stripping out volatile components such as food and power quickened to a record 5.6% last month even as a retreat in energy costs helped bring the headline number down for a fourth month.

The European Central Bank is set to hike borrowing costs by another half-point when it meets next week, adding to the most aggressive tightening push in its history. There’ll probably be more to come in the following months, with the full force of action to date also expected to weigh on output this year.